boulder co sales tax rate 2020

What is the sales tax rate in Boulder Colorado. Notice that we use 2020 millage rates since 2021 rates are not available yet.

About City of Boulders Sales and Use Tax.

. Month-Over-Month Change in Retail Taxable Sales. Boulder CO Sales Tax Rate. Without the large audit payment that was recorded in March 2020 sales tax revenue would have declined -23 Chart 3.

Microsoft Word - 2020 Sales Tax. 2055 lower than the maximum sales tax in CO. The current total local sales tax rate in Boulder County CO is 4985.

The December 2020 total local sales tax rate was 8845. This report provides information and analysis related to 2020 unaudited taxes and fees including sales and use tax accommodations tax. For tax rates in other cities see Colorado sales taxes by city and county.

A county-wide sales tax rate of 0985 is applicable to localities in Boulder County in addition to the 29 Colorado sales tax. The December 2020 total local sales tax rate was also 4985. Boulder Countys Sales Tax Rate is 0985 for 2020 Sales tax is due on all retail transactions in addition to any applicable city and state taxes.

The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and. When Boulder County resident Howard Derby first spoke with the Camera in early 2019 about his concerns with property tax values assigned by the assessors office to homes. The Colorado state sales tax rate is currently.

As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components. City of Boulder January 2020 Revenue Report. Footnotes for County and Special District Tax.

This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Boulder Colorado is. The current total local sales tax rate in Boulder CO is 4985.

The ESD tax is on top of the City of Boulder sales tax rate of 386. Sales Tax Rates in Revenue Online. Two services are available in Revenue Online.

The Boulder County Sales Tax is 0985. The Boulder County Remainder Colorado sales tax is 499 consisting of 290 Colorado state sales tax and 209 Boulder County Remainder local sales taxesThe local sales tax consists. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Boulder County Colorado is. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs. 1 2015 onward the exemption will be.

Tax description Assessed value. Some cities and local. Find both under Additional Services View Sales Rates and Taxes.

1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee. Boulder County does not issue licenses for sales tax as the county sales tax is collected by the Colorado Department of Revenue CDOR. Prior Year Sale Information.

The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. The 2020 Boulder County sales and use tax rate is 0985. Legislation passed in 2008 increases Colorados business personal property tax exemption to 7000 over five years.

Boulder County CO Sales Tax Rate. 2 Rate includes 05. From the tax year beginning Jan.

The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city. You can print a 8845 sales tax table here. Boulder co sales tax rate 2020 Sunday March 20 2022 Edit.

View Local Sales Tax Rates. County of Boulder 0985 Sales Tax Use tax on Building Materials and Motor Vehicles Open Space 0475 0125 ending 123134 010 ending. Boulder County Niwot Lid.

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Cience Debuts At 31 In The Financial Times Americas Fastest Growing Companies 2020 Send2press Newswire Financial Times How To Start Conversations Financial

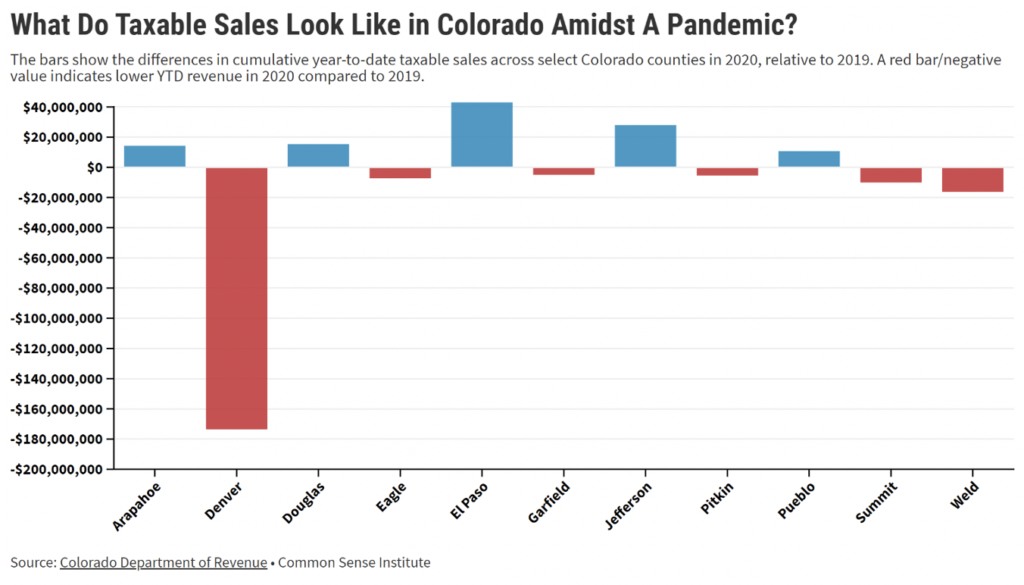

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Nevada Sales Tax Guide For Businesses

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Nevada Property Tax Calculator Smartasset

Colorado Property Tax Calculator Smartasset

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Individual Income Tax Colorado General Assembly

Colorado Sales Tax Rates By City County 2022

Sales Tax Drops In January First Month To Month Decline Since August 18 News Chaffeecountytimes Com